Bookkeeping is a critical part of running a business, but it’s also an area where small mistakes can have big consequences. Even seasoned business owners can make errors in their bookkeeping that lead to inaccurate financial reports, missed opportunities, or even legal trouble. Here are five common bookkeeping mistakes and tips on how to avoid them:

1. Failing to Track All Business Expenses

Not recording every business expense can lead to an incomplete financial picture and missed tax deductions. This is especially problematic for small expenses, such as office supplies or meals, that can add up over time. To avoid this, consider using accounting software or mobile apps that allow you to track expenses in real time. Regularly reviewing your expense records also helps ensure nothing falls through the cracks.

2. Mixing Personal and Business Finances

One of the most common bookkeeping mistakes is blending personal and business finances. When personal and business transactions are mixed, it becomes difficult to keep accurate financial records and properly report your business’s income and expenses. The solution is simple: always maintain separate bank accounts and credit cards for your business. This practice not only keeps your books clean but also protects you in case of an audit.

3. Neglecting to Reconcile Bank Accounts

Reconciling your business’s bank and credit card statements with your bookkeeping records is essential for ensuring accuracy. Failing to reconcile accounts can lead to discrepancies and errors that go unnoticed. Make it a habit to reconcile your accounts monthly. This process allows you to catch mistakes early, such as duplicate charges or missed transactions, and ensures that your financial records match your actual cash flow.

4. Inconsistent Record-Keeping

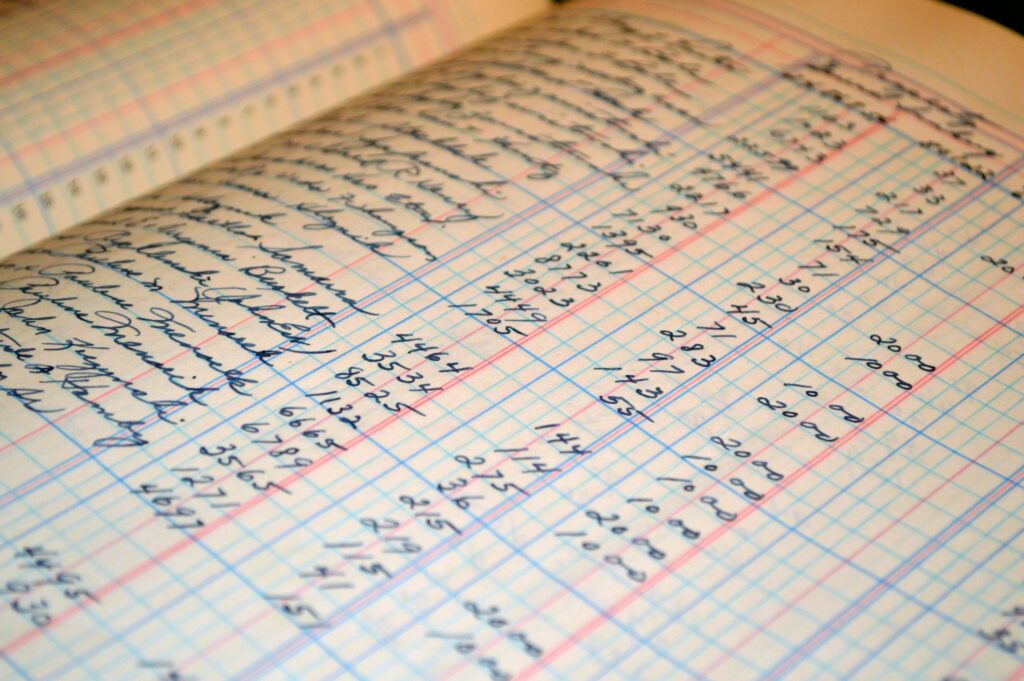

Inconsistent bookkeeping, such as not recording transactions regularly, can lead to inaccuracies in your financial statements. For example, forgetting to record income or expenses as they happen can create cash flow issues and make tax time much more difficult. To avoid this, establish a regular bookkeeping schedule. Whether you update your records daily, weekly, or monthly, consistency is key to maintaining accurate financial data.

5. Overlooking Receipts

Many business owners underestimate the importance of keeping receipts for business-related purchases. Receipts provide proof of your expenses, which is especially important during tax season or an audit. Lost receipts can mean lost deductions, which can increase your tax liability. A simple solution is to digitize your receipts by using an app that allows you to take pictures and store them electronically. This makes it easier to organize, retrieve, and preserve your expense documentation.

Conclusion

Avoiding common bookkeeping mistakes is essential for keeping your financial records accurate and your business running smoothly. By tracking expenses in real time, keeping personal and business finances separate, reconciling accounts, maintaining consistent record-keeping practices, and safeguarding receipts, you can avoid headaches and set your business up for long-term success. Accurate bookkeeping will save you time, reduce stress, and give you a clearer picture of your business’s financial health.

Blog 5- 5. The Benefits of Cloud-Based Bookkeeping for Remote Work

As remote work continues to grow, cloud-based bookkeeping has become an invaluable tool for businesses looking to manage their finances efficiently. Whether you’re a small business owner, freelancer, or part of a remote team, cloud-based bookkeeping offers several advantages over traditional methods. Here’s why cloud-based bookkeeping is the perfect solution for today’s remote work environment:

1. Accessibility from Anywhere

One of the biggest benefits of cloud-based bookkeeping is its accessibility. Since the software is hosted online, you can access your financial data from any location with an internet connection. Whether you’re working from home, traveling, or at a client’s office, cloud-based systems allow you to check your finances, update transactions, and review reports anytime, anywhere. This flexibility is essential for remote teams or business owners who are constantly on the move.

2. Real-Time Updates for Accurate Decision-Making

Cloud-based bookkeeping provides real-time updates, ensuring that your financial data is always current. When you record transactions, update inventory, or reconcile accounts, the system immediately reflects those changes. Real-time access to financial information allows business owners to make informed decisions quickly, whether it’s approving a purchase, adjusting budgets, or planning for tax payments. This level of transparency is especially important for remote teams that need to collaborate and stay aligned on financial goals.

3. Efficient Collaboration with Remote Teams

Cloud-based bookkeeping fosters collaboration by allowing multiple users to access and work on the same financial data simultaneously. Team members can enter transactions, generate reports, and review financial statements without needing to be in the same physical location. Permissions can be assigned based on roles, ensuring that sensitive financial information is only accessible to authorized users. This feature is ideal for businesses with remote accountants, bookkeepers, or financial teams.

4. Cost-Effectiveness and Flexibility

Cloud-based bookkeeping software is often more cost-effective than traditional accounting systems. Most cloud providers offer tiered pricing based on the size and needs of your business, so you only pay for what you use. There’s no need to invest in expensive hardware, and updates are automatically applied without additional costs. Additionally, cloud-based systems scale with your business, making them ideal for startups and growing businesses alike.

5. Enhanced Data Security

Data security is a major concern for businesses handling sensitive financial information. Cloud-based bookkeeping platforms use advanced encryption methods and multi-factor authentication to protect your data. Regular backups and automatic updates ensure that your financial records are safe from data loss, theft, or system failures. With cloud-based solutions, your data is stored in secure, encrypted servers, offering peace of mind that your financial information is protected at all times.

6. Automation for Improved Efficiency

Cloud-based bookkeeping systems offer automation features that can streamline many time-consuming tasks. For example, automated invoicing, payroll, and expense tracking save time and reduce the likelihood of human errors. These systems can also integrate with other cloud-based tools, such as customer relationship management (CRM) software, inventory systems, or tax preparation platforms, allowing you to automate the flow of data across various business functions.

Conclusion

Cloud-based bookkeeping is a game-changer for businesses, especially in the remote work era. With accessibility, real-time updates, collaboration capabilities, cost savings, enhanced security, and automation, cloud-based bookkeeping empowers business owners and their teams to manage finances efficiently and accurately, no matter where they are located. Embracing cloud-based bookkeeping is an essential step toward a more flexible and productive remote work environment.